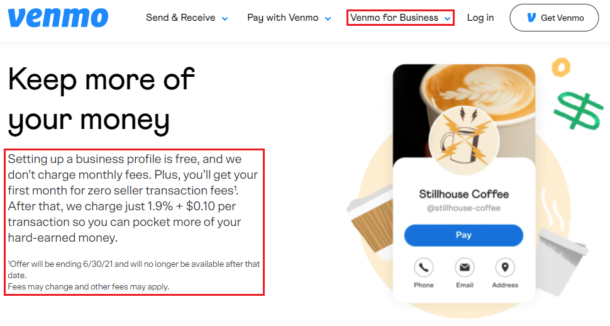

There is no filing system (this is a peer-to-peer payment network, after all), no monthly reports, and no way to total up your payments for tax filings. Secondly, doing business in this "off the books" manner could also land you in trouble with the IRS. Users caught in breach of this rule can have those thought to be business transactions removed from their account, meaning you could lose everything that went into the food order in question. It's Prohibited By Venmo and Could Result in an Account Freezeįirst and foremost, using a personal account to accept business payments is explicitly banned. Whether you own a hole-in-the-wall diner or a food truck, there are some serious reasons you should avoid using Venmo as your principal method for accepting payments. Why Should Food Business Owners Avoid Using Venmo? But there are serious issues with operating your business in this manner, as we shall now explain. Those operating small food businesses such as food trucks and take-out only use the absence of fees as an opportunity to process payments made by customers for nothing. Using a personal Venmo account incurs no fees (unless you use a credit card to fund a Venmo balance which comes in at 3% passed on directly from the credit card companies). Well, in short, to get around payment processing fees. Why Do Some Small Restaurant Owners Use Venmo to Take Payments? The service allows users to send and request money from one another without having to pay any fees, which has tempted some food business owners to use it for processing customer payments. Over the last few years, Venmo has emerged as the leading mobile payment network among millennials in the United States. Venmo was launched in 2009 and was later acquired by PayPal in 2013 during their acquisition of Braintree. So if you're thinking of using Venmo to accept payments for your food business, read on to understand why we don't recommend this payment processing method.

However, using this peer-to-peer payment network is going to give you more trouble than you might have thought.

That's why some business owners have the idea to use Venmo to accept payments.

From interchange fees to acquiring fees, there seems to be a cut taken from at each stage of the payment process. The issue is the fees involved in payment processing can be murky at the best of times. And with the majority of US diners preferring to pay with their credit or debit card, you'll need to find a payments company willing to process those transactions on behalf of your business. Without customer payments, you have no revenue. Once you've set up your restaurant or food business, one of the first things you need to do is accept payments.

0 kommentar(er)

0 kommentar(er)